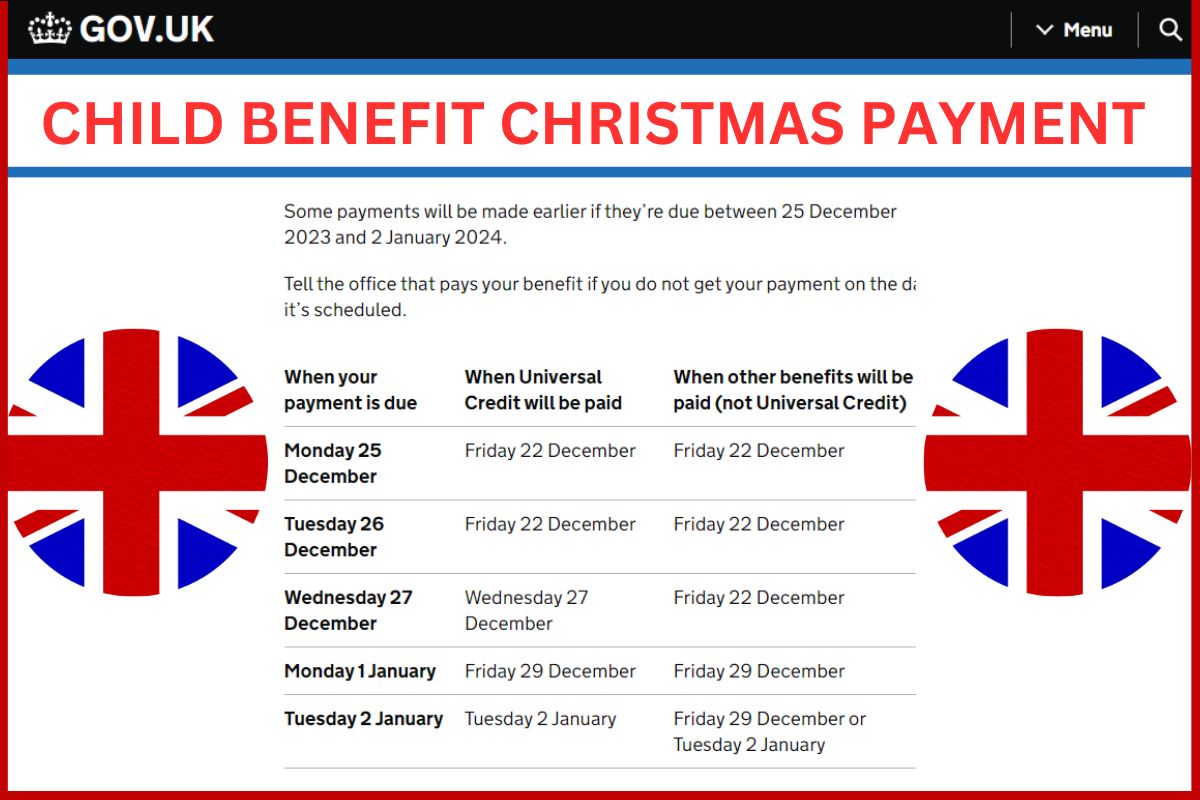

Child Benefit Christmas Payment Dates Amount Online Gov Uk

After that child tax credit which was distributed in monthly payments. For taxes filed in 2023 and afterward you can only claim benefits of 2000 for every child under 17 years. According to the framework the maximum refundable portion of Child Tax Credit would increase from the. Work requirements would remain but low-income families who dont pay income taxes could get up to. You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all. Tax credit per child for 2023 The maximum tax credit per qualifying child is 2000 for children under 17..

How to claim Responsibility for a child Overview You can only make a claim for Child Tax Credit if you already get. Child Tax Credit is paid to parents whether working or not who are responsible for a child aged up to 16 or. Contact details for the Tax Credits Helpline and Tax Credit Office which gives information about Working Tax. Youll get extra child tax credits for each child or young person youre responsible for who either. It is a significant number - on the most recent figures there are 140000 families in Northern Ireland. The Child Benefit and Child Tax Credit Persons of Northern Ireland Amendment Regulations 2020. You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all..

Child Tax Credit 2023 Credit Amount Payment Schedule Requirements

Ron Wyden D Ore and Rep Jason Smith R Mo said the plan includes a phased increase to the refundable portion of the child tax credit CTC for 2023 2024 and 2025 and. The legislation would increase that amount to 1800 in 2023 1900 in 2024 and 2000 in 2025 It would also adjust the limit in future years to account for inflation. Expired at the end of 2021 Child poverty spiked by 41 percent in January after Biden benefit program expired study finds for the current tax credit Although far from final. January 10 2024 at 436 pm Congress is nearing a deal to partially restore an expansion of the child tax credit which expired in 2021 in exchange for extending some corporate tax. Democrats are eager to bring back an expanded child tax credit after having enacted a huge benefit for one year which sharply cut child poverty before the tax credit expired in 2022..

How to claim Responsibility for a child Overview You can only make a claim for Child Tax Credit if you already get. Updated 27 November 2023 These tables show rates and allowances for tax credits Child Benefit and Guardians..

Comments